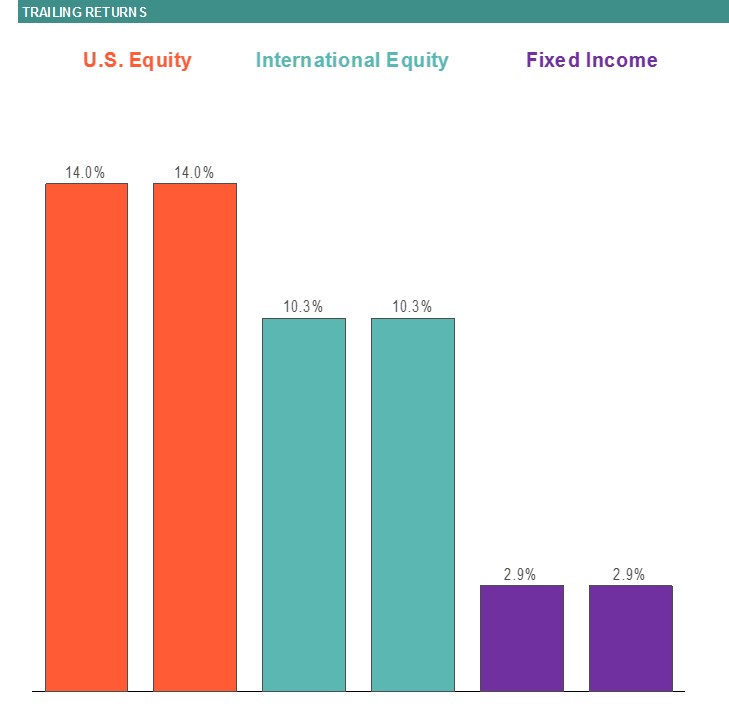

- U.S. equity markets rebounded sharply up 14% (Russell 3000) in the first quarter on progress with China trade talks and more dovish comments from the Federal Reserve.

- International equities rallied as well, posting a 10.3% gain over the quarter (MSCI ACWI ex U.S.).

- The U.S. fixed income market was up 2.9% for the quarter (Bloomberg Barclays Aggregate) as interest rates declined. Additionally, the yield curve briefly inverted in late March with 3-month T-bills yielding more than 10-year Treasuries.

- The U.S. labor market remained tight with March unemployment at 3.8%.

- U.S. GDP growth remained solid in the fourth quarter up 2.2%. However, this was a deceleration from the third quarter pace.

- Growth stocks resumed their outperformance this quarter with the Russell 1000 Growth outperforming the Russell 1000 Value by 4.2%.

- The Federal Reserve signaled a pause in rate increases as they evaluate the extent of the global economic slowdown.

Copyright © 2024

Spay and Associates